In this post several universes will be sampled using the

Elastic Asset Allocation model. The universes under review are:

-

CXO Advisory's 8 assets simple momentum universe

-

Stefan Solomons 12 assets tactical allocation universe

-

ETFdb.com's most popular ETFs

- CXO's on steroids: a 300% leveraged universe

The backtests are performed using monthly

Yahoo! Finance total return data with EAA in Equal Weigted Hedged mode with monthly reforms. So each month assets are (re-)alloced according to the below simplified formula:

if ri > 0 else wi = zi = 0

ETFs are

extended using mutual fund data to attain a backtest period of 20 years (1995 - 2014)

*.

CXO Advisory's 8 assets simple momentum universe

The line-up for CXO's is DBC, EEM, EFA, GLD, IWM, IYR, SPY and TLT. Since the liquidity of CXO's original IWB is way lower than that of its bigger sibling SPY, the latter was used. IEF is deployed as c(r)ash protection fund (CPF), but is kept outside the regular allocation basket. The maximum number of assets for capital allocation is limited to 3+1.

|

| CXO: equity curve with key performance indicators |

|

| CXO: yearly returns |

|

| CXO: profit contributions |

|

| CXO: 2 standard deviations confidence channel (95%) for rolling 1 year returns |

|

| CXO: Manhattan allocation diagram showing the waxing and waning of the CPF (upwards from bottom) |

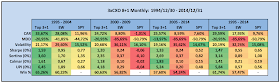

Stefan Solomons 12 assets tactical allocation universe

Some 18 months ago Stefan joined the discussion about the

Conceptual Sketch post. In one of his comments, he stated the ETFs selection is the key

piece of this type of system. At that time Stefan settled for: SPY, IWM, EFA, EEM, ICF, RWX, HYG, EMB, DBC, GLD, TLT, LTPZ. With 12 assets in the basket and IEF as CPF, this universe is given an allocation limit of 4+1 funds, which actually yields a better performance on all but one metrics compared to the 3+1 limit (CAR is 0.28% lower).

|

| SS12: equity curve with key performance indicators |

|

| SS12: yearly returns |

|

| SS12: profit contributions |

|

| SS12: 2 standard deviations confidence channel (95%) for rolling 1 year returns |

|

| SS12: Manhattan allocation diagram |

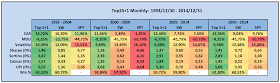

Most popular Top25 universe

ETFdb keeps track of the Top100 most heavily traded exchange-traded products. Inspired by this list the Top25 universe is a selection with non-leveraged ETFs only: AGG, DBC, EEM, EFA, EWJ, FEZ, FXI, GLD, IWM, IYR, JNK, LQD, MDY, QQQ, SHY, TLT, XLB, XLE, XLF, XLI, XLK, XLP, XLU, XLV and XLY. With 25 assets and IEF kept outside the basket as CPF, the allocation limit for this universe is set to 5+1.

|

| Top25: equity curve with key performance indicators |

|

| Top25: yearly returns |

|

| Top25: profit contributions |

|

| Top25: 2 standard deviations confidence channel (95%) for rolling 1 year returns |

|

| Top25: Manhattan allocation diagram |

CXO's on steroids

From CXO's original basket EEM, EFA, IWM, IYR, SPY and TLT are replaced with their 300% leveraged versions, resulting in the following universe: DBC, DRN, DZK, EDC, GLD, TMF, TNA and UPRO (the replication process as well as the necessity for some salt is

explained here). Again IEF is used as the external CPF. For this wild pack faster settings for EAA are suitable resulting in a responsive model. Therefore

ri is based on 1 and 3 month returns only.

Acknowledgement for researching CXO's tripled universe goes to Aurelia. Nice trouvé.

|

| 3xCXO: equity curve with key performance indicators |

|

| 3xCXO: yearly returns |

|

| 3xCXO: profit contributions |

|

| 3xCXO: 2 standard deviations confidence channel (95%) for rolling 1 year returns |

|

| 3xCXO: Manhattan allocation diagram |

Leveraged CXO's untamed

Switching off EAA's c(r)ash protection routine unleashes the triple leveraged universe to its full extent.

|

| EAA-model settings for 3xCXO CPF off |

|

| 3xCXO CPF off: equity curve with key performance indicators |

|

| 3xCXO CPF off: yearly returns |

|

| 3xCXO CPF off: monthly profit table with yearly CARs and MaxDDs |

|

| 3xCXO CPF off: Manhattan allocation diagrams. Notice the difference with the above MADs. |

* Please note 1994 is not part of the backtest period for comparability reasons. However 1994 was a particular nasty year for all presented universes resulting in worse performance metrics by a few tenths of a percent for the non-leveraged universes. This affects CAR as well as MaxDD. For the leveraged universe differences are somewhat bigger:

|

| 3xCXO CPF off covering 1993 - 2014 |

|

| Draw down chart for 3xCXO CPF off covering 1993 - 2014 |

The modified version of the AmiBroker code is available upon

request. The model now has quarterly reforms and three CP settings implemented too. Interested parties are encouraged to support this blog with a donation.