- HAA aims to offer retail investors a tactical asset allocation strategy that is both balanced and aggressive at the same time.

- HAA’s hybrid approach combines traditional dual momentum with canary momentum which results in robust crash protection with low cash-fractions.

- HAA effectively selects assets only when they are most likely to appreciate.

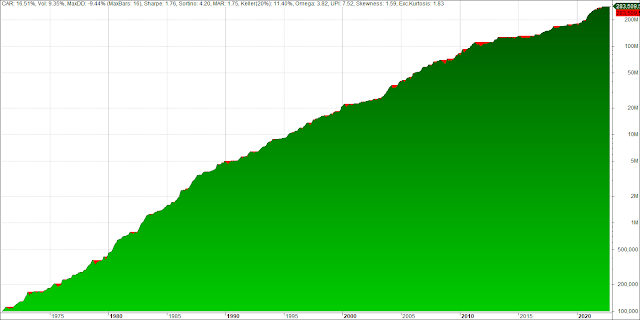

- HAA’s ability to obtain positive returns consistently is demonstrated by backtesting the strategy for over 50+ years covering various economic regimes.

Hybrid Asset Allocation (HAA) is a novel approach which combines “traditional” dual momentum with “canary” momentum. Dual momentum is based on the concept of assets price trends and consists of absolute (trend following) and relative (cross-sectional) momentum. In addition to the traditional dual momentum framework HAA adds an extra layer for crash protection at the portfolio level based on a single canary asset in the protective (or canary) universe. HAA allows only for offensive investments when the canary asset is uptrending and switches in full to defensive investments if and for as long as this asset is not uptrending. Interested readers are referred to our paper published on SSRN which offers a comprehensive explanation of the HAA methodology including explanations of the used jargon and abbreviations.

HAA effectively utilizes the dual momentum framework for harvesting risk premia in financial markets by only allocating capital to assets when they are most likely to appreciate. To this effect three different universes are deployed: a protective, an offensive, and a defensive universe.

First for early crash warning the trend of the overall market is assessed through a single canary asset, for which we have taken into account the recent (2022) stagflation-like regime with low equity growth and rising yields/inflation, including possible recessions by ‘inverted- yield-curves’ from FED actions like interest hikes and tapering. Hence our choice for HAA’s dedicated canary asset needs to be sensitive not only to rising yields but to rising (expected) inflation too. When the canary momentum is positive, cross-sectional relative strength momentum is used for selecting the best assets with the highest performance while trend-following absolute momentum reduces potential drawdown by replacing best but “bad” (non-positive) risky assets to a safe harbor short-term or intermediate-term treasury bond fund, as is fully the case when canary momentum is “bad”. For all three universes one and the same momentum filter is applied.

The objective of HAA was to design an investment strategy that is both balanced and aggressive at the same time, while specifically aiming for low cash-fractions despite robust crash protection. We had to consider that small top sizes happen to be more aggressive but less balanced, while smaller universes tend to improve the effectiveness of absolute momentum based crash protection. To combine these opposite characteristics, we found a top size of four assets out of four different financial asset-classes with two assets per class for broad diversification to be a good compromise.

For HAA-Balanced, which is our preferred setup for HAA, four different financial asset-classes are equally present in a global offensive investment universe to achieve diversified portfolios:

- US Equities: large cap S&P 500 (SPY) and small cap Russell 2000 (IWM)

- Foreign Equities: developed markets (VEA) and emerging markets (VWO)

- Alternative Assets: commodities (DBC) and US real estate (VNQ)

- US Bonds: 7-10y Treasury (IEF) and 20y Treasury (TLT)

The protective (or canary) universe and the defensive universe for capital preservation are populated by one and two US Treasury funds, respectively, regardless of the size and composition of the offensive universe:

- Canary universe: US Treasury Inflation Protected (TIP)

- Defensive universe: US 1-3m T-Bill (BIL) and 7-10y Treasury (IEF)

Within the defensive universe, being able to (only) select the safe harbor fund with the highest momentum out of short-term T-Bills or intermediate-term Treasury bonds adds the benefit of alternation, making the safety module to a large extent immune to rising rates while allowing for the prospect of “crisis alpha” too.

The HAA recipe

On the close of the last trading day of each month t:

- Calculate the momentum of each asset in the offensive, defensive (BIL, IEF) and canary (TIP) universe, where momentum is the (unweighted) average total return over the past 1, 3, 6, and 12 months (13612U) and rank assets based on their momentums for each universe separately.

- Select only the best defensive “cash” asset (BIL or IEF) when TIP’s momentum is non-positive (13612U <= 0), or else allocate 1/TopX of the portfolio to each of the best TopX half of the risky assets (equally weighted), while replacing each of those TopX assets by the best defensive “cash” asset when it has non-positive momentum.

- Hold all positions until the final trading day of the following month. Rebalance the entire portfolio monthly, regardless of whether there is a change in positions.

In our paper on SSRN we selected the HAA-Balanced strategy with a Top4 out of 8 global assets in the offensive universe: SPY, IWM, VEA, VWO, VNQ, DBC, IEF, TLT (G8/T4) and the HAA-Simple strategy with just one US offensive asset (SPY only). Please refer to our paper for the demonstration of the robustness of HAA-Balanced with 4x4, 4x3, 4x2, and 4x1 sized offensive universes, for each of which our design objectives were met. As pointed out in our paper, HAA with only SPY as offensive asset might just be a “lucky shot”, since other choices for a single investment asset result in considerably higher drawdowns. With that out of the way, for both flavors of HAA performance details are shown below.

Performance overview

The following tables, charts, and diagrams provide a detailed view on the performance of (G8/T4) and HAA-Simple (SPY only). Results are derived from monthly total return ETF data extended with calibrated indices. Furthermore, risk-free rates, trading costs, slippage, and taxes are disregarded. Results are therefore purely hypothetical. Past performance is no guarantee of future results.

The key performance indicators for both of HAA’s flavors show that HAA-Balanced’s diversification over four different asset classes results in lower volatilities, drawdowns, and cash allocations for nearly all sample periods combined with higher reward/risk ratios when compared to HAA-Simple. Notice especially HAA-Balanced’s very low cash fraction CF on full sample, which was one of our main design objectives.

The smooth upwards slope of especially HAA-Balanced’s portfolio equity curve reflects the consistent profitability as well as its low portfolio volatility. Notice however the deeper and at times prolonged troughs in HAA-Simple’s chart during drawdown periods.

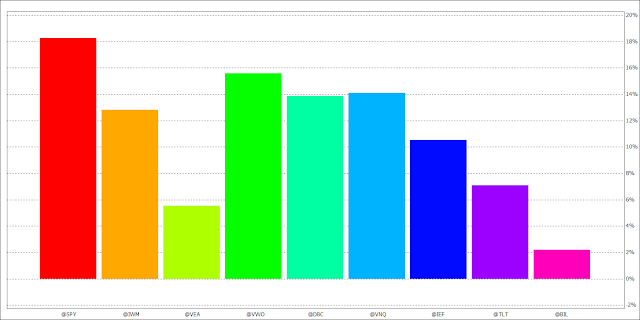

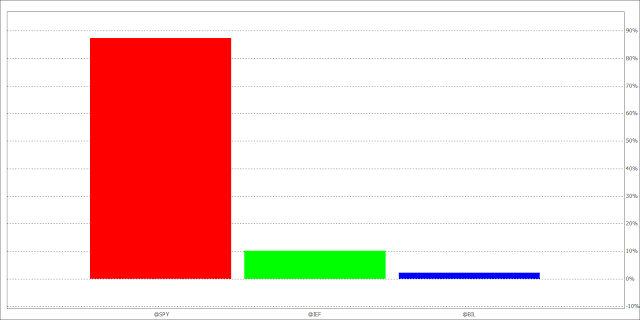

The histograms depicting profit contributions clearly illustrate the difference between the Balanced and Simple versions. All four market sectors contribute to HAA-Balanced’s performance, while by design HAA-Simple almost entirely depends on its singular offensive asset SPY.

The diagrams below show the allocation percentages to HAA’s defensive universe over more than half a century. Notice in the lower pane the binary all in/out (0/100%) approach of HAA-Simple due to its single risky asset (N1/T1). Because “bad” Top4 assets are replaced by the best safe harbor fund, HAA-Balanced offers more top selection choices (0, 25, 50, 75, and 100%), which at times results in mixed offensive/defensive portfolio allocations (0% < CF < 100%) as the upper pane shows. For reference the middle pane shows the cash fractions based on the canary momentum of TIP only, so without hybrid protection's absolute momentum filter for the offensive universe.

By combining traditional dual momentum with inflation protected canary momentum HAA results in robust performance when applied to diversified investment universes. With a winning month ratio of around 70% especially HAA-Balanced is favorable for sustaining a retail investor’s most important investment ability of all: “the emotional discipline to execute their planned strategy faithfully, come hell, high water, or the apparent end of capitalism as we know it.” (William J. Bernstein, The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between).

Strategy signals

A signals table for Hybrid Asset Allocation with the above mentioned setups will be added to the Strategy Signals page in due time. Until then, the table is fully functional below. Please take note of the limitations as mentioned on the Strategy Signals page.

[Datalink with GoogleFinance appears to be working again, so reversed back to VEA]

NB! No guarantee whatsoever is given for the soundness of the strategy nor the proper functioning of the table nor the accuracy of the (time delayed) signals. Please do your own due diligence and use at your peril. The Important Notice in the footer applies as well as the Disclaimer.

Endnotes

- The AmiBroker implementation of HAA supports flexible segmenting to support different portfolio sizes as described in our paper on SSRN.

- AllocateSmartly.com has added HAA to their collection of the industry’s best tactical asset allocation strategies (members area). For a good understanding of HAA be sure to check out their blog too (public area).

- All TAA-papers by prof. Keller (lead author) are freely available on SSRN.

The full AmiBroker code for HAA is available upon request. Interested parties are encouraged to support this blog with a donation:

.png)

.png)